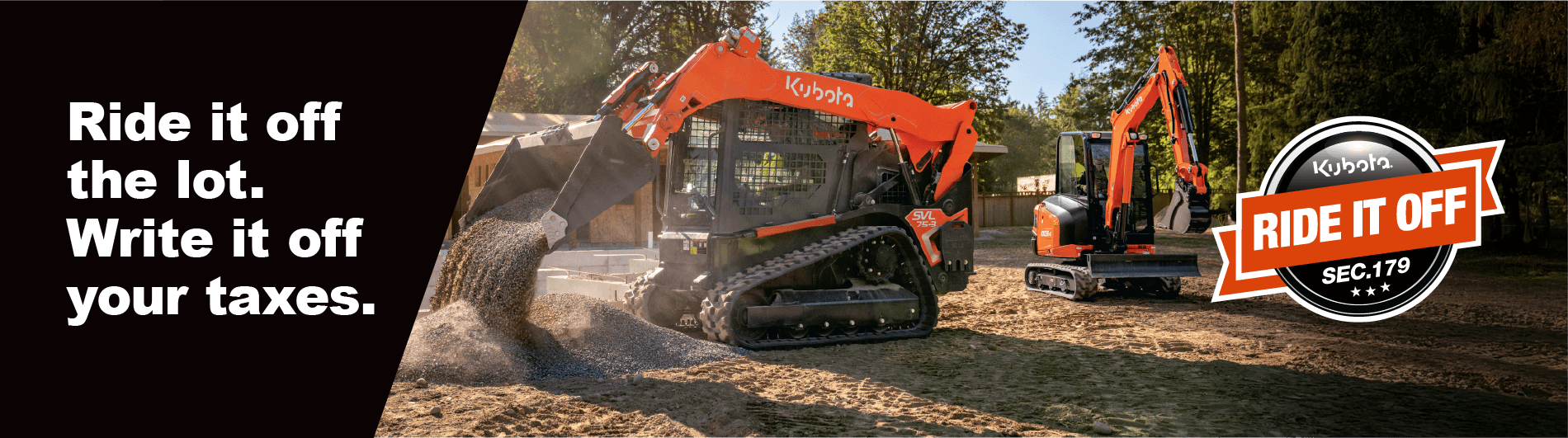

If you’re a business owner, Section 179 is one of the best tools you can use to save money this tax season. At Walker and Walker Equipment, we’ve seen firsthand how this deduction helps our customers upgrade their equipment, expand their operations, and keep more cash in their pockets. Let’s break down what Section 179 means for you and how you can make your next Kubota purchase work harder for your business.

Section 179 is a U.S. tax incentive created to support small and mid-sized businesses. It allows you to deduct the full purchase price of qualifying equipment in the same year it’s purchased and placed in service rather than spreading the deduction over several years. At Walker and Walker Equipment, many of our tractors, construction equipment, and agricultural implements qualify for this deduction. Section 179 helps reduce your tax burden while giving you the freedom to reinvest in your business today.

Take advantage of Section 179 and put your business in a stronger position. Key benefits include:

With Section 179, upgrading your equipment isn’t just an investment in tools—it’s an investment in your business’s future.

Claiming your Section 179 deduction is simple, but it’s important to follow IRS guidelines. File IRS Form 4562 with your business tax return for the year your equipment is placed in service. The deduction cannot exceed your business’s taxable income, though any unused portion may carry forward to future years. State rules and equipment type can affect your deduction, so planning ahead is key.

At Walker and Walker Equipment, our team is here to help you navigate the process. Visit any of our three locations or fill out the form below for expert guidance and personalized assistance.

For more information on Section 179, visit the official IRS website. Note that Walker and Walker Equipment is not a source for tax or legal advise. Consult your tax advisor or a legal professional for complete details on Section 179.

Contact Us!